Today’s customers have very high expectations for brands when it comes to customer service and personalisation.

Think about companies like Zappos and Zoom who have made a name for themselves by prioritising customer needs over squeezing out profit.

If your company isn’t following in their footsteps, you’re likely missing out on attracting new customers and, more importantly, satisfying your current customers.

This is where customer retention analytics come in.

Customer retention analytics help you determine where and why your customers are churning, and what you can do to fix this point in your customer journey.

Learn more below about the different methods for tracking customer retention analytics and extra tips for how to put these methods into practice.

What is Customer Retention?

Customer retention is the practice of keeping existing customers, as opposed to customer acquisition, which is the practice of attracting new customers.

Both are important strategies for a healthy business, but focusing on customer retention especially is key for scaling and growing over time.

What Are Customer Retention Analytics?

Customer retention analytics are the metrics you gather and measure in order to determine how satisfied your existing customers are and what you can improve on to keep them satisfied.

They measure the relationship between a customer and a brand to help predict when and why that customer might leave.

These metrics can include things like what the customer purchased, when they purchased it, if they’re a repeat customer, if they had issues with a return, when and why they churned, and any other important step in the buyer journey.

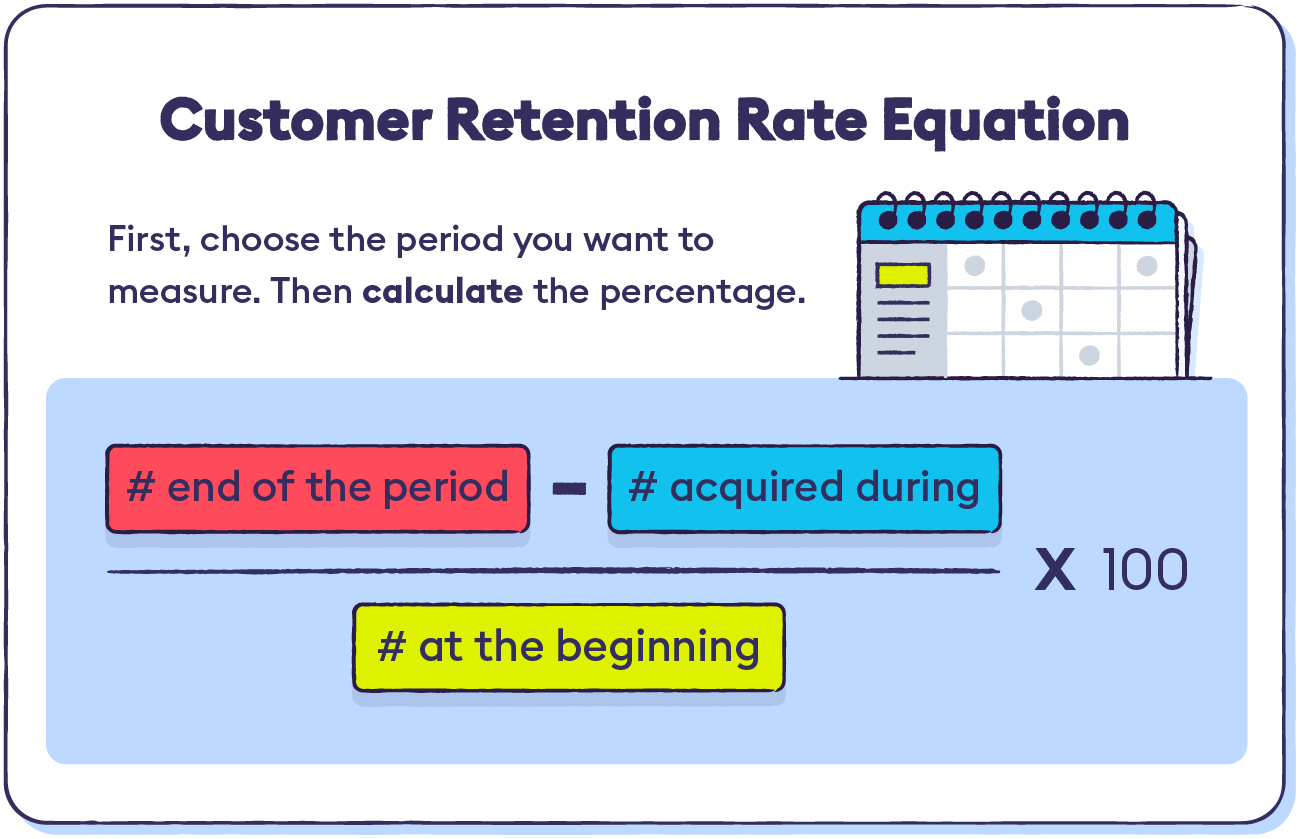

To calculate your customer retention rate as a percentage, you can use a simple equation.

First, decide on the period of time you want to measure. This is usually a month, a season, or a year.

Then, take the total number of customers at the end of that period, and subtract your new customers acquired during that period.

Next, you divide that number by the number of customers you had at the beginning of the period. To turn this into a percentage, you simply multiply by 100 to get your customer retention rate.

((# end of the period - # acquired during)/# at the beginning) X 100

Read More:How to Calculate Customer Retention Costs

Why Are Customer Retention Analytics Important for Business?

While the customer retention rate tells you the what customer retention analytics can tell you the why and the how. Here are some of the many benefits of tracking customer retention analytics in your business.

1. Lower CAC By Keeping Existing Customers

The most obvious goal of tracking customer retention analytics is to lower your CAC (customer acquisition cost) by keeping existing customers happy.

The less you have to spend on acquiring new customers, the more you can spend in other areas to grow and improve your business.

Studies have shown that the costs associated with acquiring a new customer can be up to 25 times more than for retaining an existing customer, so it’s definitely worth the time and effort to prioritise retaining your current customer base.

2. Provides Greater Insight on CX

Incorporating customer retention analytics into your overall CX (customer experience) strategy gives you the necessary insight to make changes that will directly affect your bottom line by maintaining your existing customer base.

There are a variety of CX metrics you should be tracking, such as NPS (net promoter score), CSAT (customer satisfaction), and CES (customer effort score), and customer retention analytics can give much needed context to these numbers.

Think of it as another piece in the customer experience puzzle.

Read More: Customer Retention Metrics & How To Measure Them

3. Allows for Steady, Sustainable Growth

As we’ve already mentioned, maintaining existing customers is much less costly than attracting new customers. Existing customers are also more predictable, as you’re able to track their habits and preferences over time, along with possible upsell opportunities depending on your business model. By focusing on improving your customer experience for people who have already interacted with your business, you’ll be able to better predict where you need to allocate resources and can grow your business with the confidence of concrete data behind you.

Read More:Why Customer Retention is So Important

5 Types of Customer Retention Analytics

There are five main types of customer retention analytics that you can use to calculate customer lifetime value, make future predictions for customer behaviour, and learn what you can do to improve various touch points.

Each is important in their own way, and most companies use a combination of each method to get a better understanding for their customer landscape.

1. Predictive Analytics

As you might expect from the name, predictive analytics help you predict customer behavior in the future.

Using data from previous buying cycles along with market-specific trends, you can create models showing how customers are likely to behave over a certain period of time.

Though of course predictive analytics isn’t 100% accurate, it’s very useful for getting ahead of trends and doing what you can to be proactive in preparing for certain issues.

2. Prescriptive Analytics

Prescriptive analytics takes predictive analytics a step further by recommending, or prescribing, a set of actions to take in order to address the predicted customer actions.

Because this type of modeling is so complex and time-consuming, many companies utilise text analytics and machine learning tools that can incorporate customer feedback and recommend courses of action to take.

3. Descriptive Analytics

While prescriptive analytics focuses on the future, descriptive analytics are the opposite and focus on the past.

Descriptive analytics compare and contrast historical data to determine trends and themes. Descriptive analytics is one of the most common methods used in general data reporting, often seen as month-over-month or year-over-year comparisons.

4. Consumption Analytics

Consumption analytics, also known as outcome analytics, measures the ways your customers are using or consuming your products and services, and how this affects your outcomes.

This method is a little harder to understand conceptually, so it’s better to think of it in practical terms. For example, say your company sells cold-weather jackets. When marketing to customers in Southern California, you discover that most families buy your jackets during spring break when they plan trips to go skiing.

Because this segment isn’t buying your product during a typical season (AKA spring instead of winter), you can adjust your marketing and customer service resources accordingly to better meet their needs and retain these customers.

5. Diagnostic Analytics

Diagnostic analytics is used to answer the “why” questions. Why did customers buy more of this product than that product, why did this season have slower sales, why did certain customers churn?

Diagnostic analytics delves into your customer data to explain why certain outcomes happened, which can help you determine what you can do to either encourage or stop these same outcomes from happening in the future.

Strategies for Reducing Churn With Customer Retention Analytics

Now that you understand why customer retention analytics are important and how you can put them into practice, here are a few best practices for how this data can be used to improve customer loyalty and retention, and reduce churn within your business.

1. Attract the Right Customers

Customer retention analytics can help you understand which types of buyers to target in the first place. By being able to track the complete buyer’s journey, from initial contact to conversion or drop-off point, you’ll be able to gain a clearer picture for which segments are the most likely to spend with your business.

For example, maybe you discover that a certain age group responds well and converts via Facebook ads, while people brought in from Google SERP ads aren’t as likely to actually buy. You’ll then know that you should be putting more of your marketing budget into your Facebook ads and scaling back your Google ads.

2. Prioritise Your Most Valuable Customers

In the same vein as the point above, customer retention analytics will also allow you to see which segments of your existing customers are the most valuable to your business's growth, and therefore where you should be allocating the most resources.

If a certain segment of customers typically only buys from you once or twice over their lifetime, but another group has the potential for repeat sales and even upsells, you’ll definitely want to prioritise retaining this segment and do all you can to make their customer experience more enjoyable.

3. Establish Flexible, Scalable KPI’s

The whole point of data collection and analysis is so that you can make decisions with confidence.

Once you have historical data to analyse and draw conclusions from, you can work with your internal teams to establish KPIs (key performance indicators) that will allow you to better track the success of your efforts. This way, you can have confidence that you are making logical decisions for your business.

It will also allow for greater collaboration between teams as everyone will have access to the necessary data and understand the exact numbers you’re working toward. However, it’s important that these numbers are flexible and scalable. The market is constantly changing and meeting a number just for the sake of that number isn’t productive.

4. Utilise Machine Learning Tools

As we talked about earlier, customer retention analytics involve complicated and time-intensive data collection and modelling. By investing in AI-backed tools, you can process data and predict outcomes faster and more accurately while freeing up valuable employee bandwidth in order to implement the suggested changes. Why assign a human to slog through the numbers when a machine can do it so much better?

Now that you have a thorough understanding of how customer retention analytics improve your business’s bottom line, learn more about how machine learning tools can empower this process by checking out our product demo, or go ahead and sign up.

.jpg)